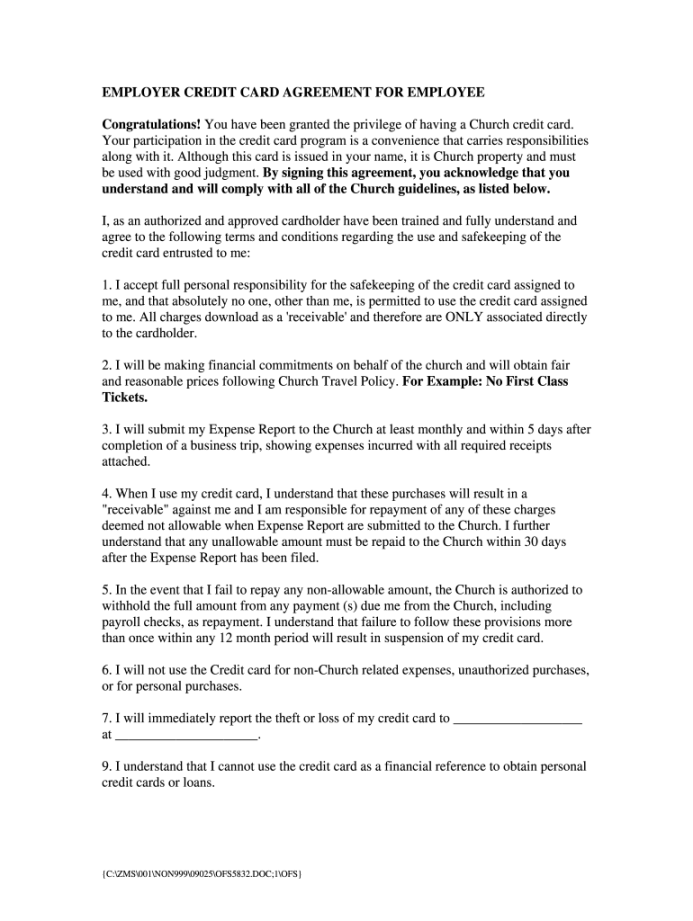

A Corporate Credit Card Agreement Template is a legally binding document that outlines the terms and conditions governing the use of a corporate credit card by an authorized employee or representative of a company. This template serves as a contract between the company and the credit card issuer, ensuring that both parties understand their rights and responsibilities.

Key Components of a Corporate Credit Card Agreement Template

A well-structured Corporate Credit Card Agreement Template should include the following essential components:

1. Identification of Parties

Company Name: Clearly state the full legal name of the company entering into the agreement.

2. Cardholder Information

Authorized User: Specify the name, position, and contact information of the employee authorized to use the corporate credit card.

3. Card Terms and Conditions

Credit Limit: Define the maximum amount that can be charged to the corporate credit card.

4. Authorized Uses

Business Expenses: Clearly define the types of expenses that can be charged to the corporate credit card. Examples include travel, meals, entertainment, and office supplies.

5. Cardholder Responsibilities

Account Management: Outline the cardholder’s responsibility for managing the account, including monitoring transactions and Reporting unauthorized charges.

6. Credit Card Issuer Responsibilities

Card Issuance: Specify the credit card issuer’s obligation to provide the corporate credit card to the authorized user.

7. Termination and Default

Termination Rights: Specify the circumstances under which either party can terminate the agreement.

8. Governing Law

9. Entire Agreement

Design Elements for a Professional Corporate Credit Card Agreement Template

To convey professionalism and trust, consider incorporating the following design elements:

Clear and Concise Language: Use plain language that is easy to understand. Avoid legal jargon that may confuse the reader.

By carefully crafting a Corporate Credit Card Agreement Template that incorporates these elements, you can create a document that is both informative and legally sound. This template will serve as a valuable tool for protecting the interests of both the company and the credit card issuer.