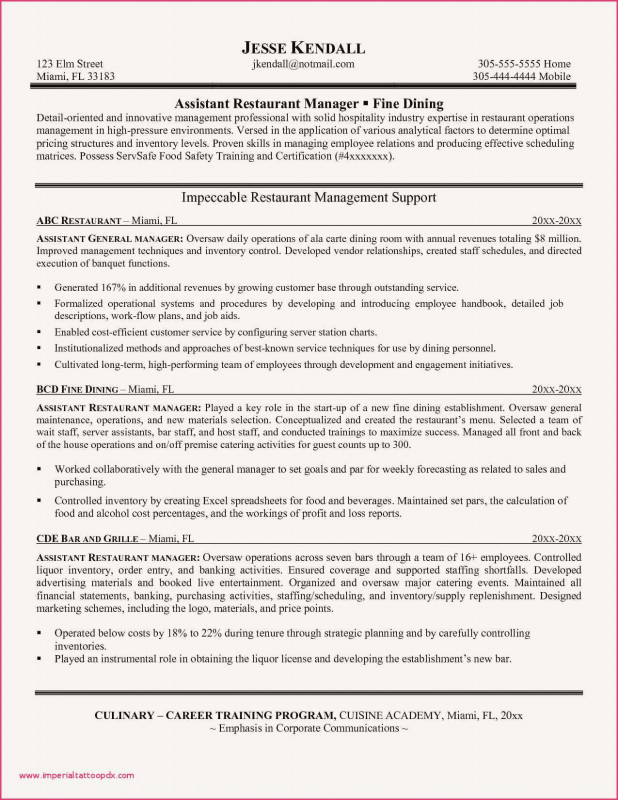

We are going to accustom a lot of parts subsequently regards to Credit Analysis Report Template which you must say yes for your guide. Absolutely it’s not difficult to find it in this website, because we prepare some of them that we have given.They are made completely flexible. In the sense that it can be adjusted or changed. We prepare various design ideas of Credit Analysis Report Template.They have a really light look. Most recently in the midst of others. You can get it in Microsoft Office Word format and regulate them well.However if you are not practiced to locate what you are searching for here then we will recommend you to type new keywords. I think the Credit Analysis Report Template which you are searching for is truly good for you in the future.

Reports are always filled gone important opinion but at the same time, they’re naturally lovely boring. People tend to look them as dry and, as a result, they stop paying attention lovely quickly regardless of how important the version at the heart of the bank account happens to be.

Now, you can guarantee this won’t happen to you with these agreed free, visually striking and gorgeously compelling version templates. Not forlorn are they agreed easy to use directly from your own Web browser, but as an extra supplementary you can furthermore choose from our library of certainly free, visually fascinating heap images to essentially encourage push your results even farther.

it is not a problem what type of instruction you’re aggravating to broadcast, what type of look you’re bothersome to create or what type of spread you want to depart people when all element you habit is nearby right in front of you.

Some benefits of using these Credit Analysis Report Template:

- Printable. It can be directly used by placing images on a worksheet (you can use Photoshop, Corel Draw, or other graphic design programs);

- Editable. This Credit Analysis Report Template can be opened and customized with Microsoft Office Word and PDF with any version;

- Easy to use by anyone;

- You can save the file for free.