A credit Card payment plan template is a structured document that outlines the terms and conditions for repaying a credit card balance over time. It is essential for both creditors and debtors as it provides a clear understanding of the repayment obligations. A well-designed template can enhance the professional image of a business and foster trust with its customers.

Key Components of a Credit Card Payment Plan Template

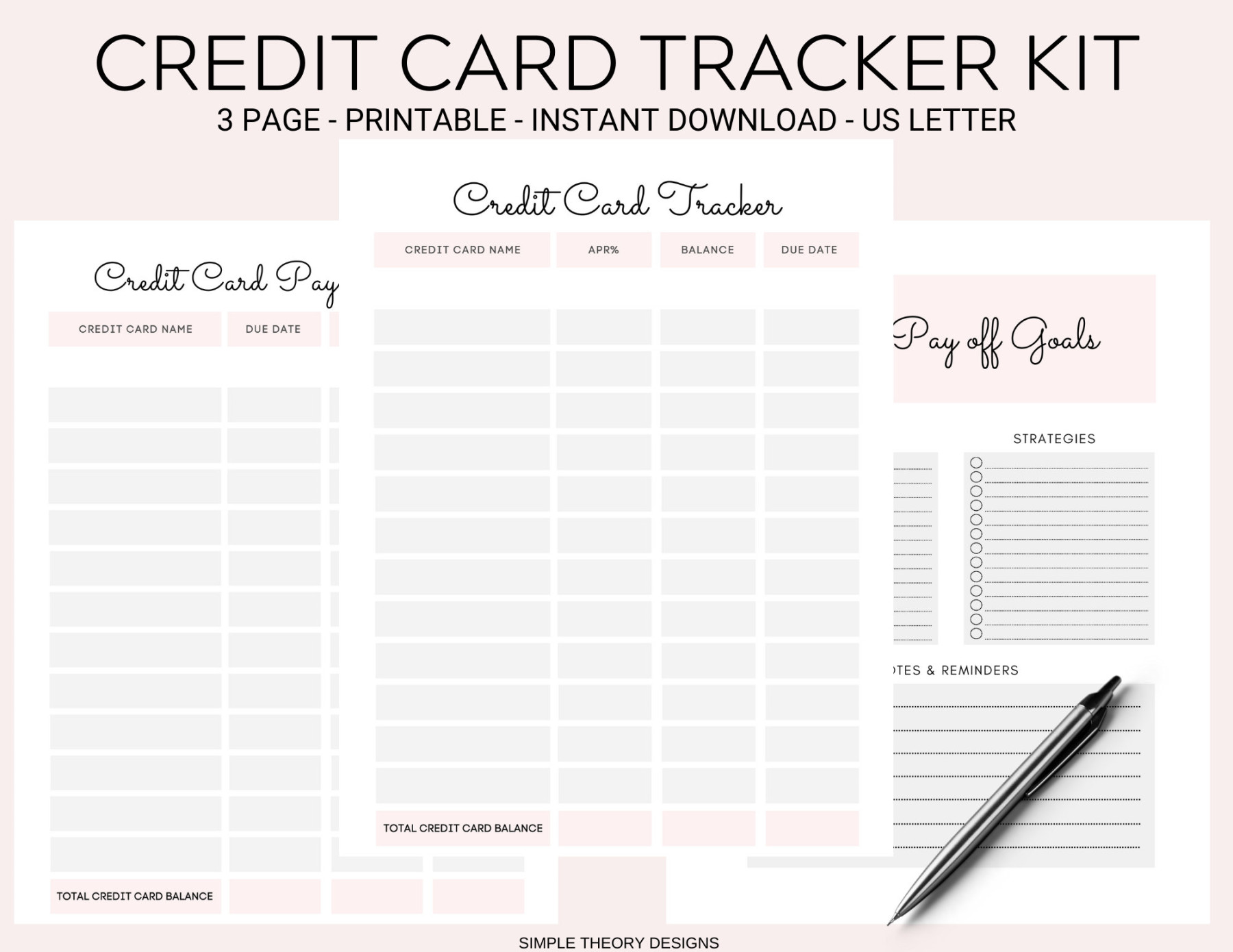

A professional credit card payment plan template should include the following essential components:

1. Header

Company Logo: Place the company’s logo prominently at the top left corner to establish brand identity.

2. Debtor Information

Name: Include the full name of the debtor.

3. Payment Plan Terms

Repayment Period: Specify the duration of the payment plan, e.g., 12 months, 24 months.

4. Payment Options

Payment Methods: List the accepted payment methods, such as credit card, check, or online banking.

5. Default and Cancellation

Default: Outline the consequences of failing to make timely payments, including potential fees or actions the creditor may take.

6. Additional Provisions

Governing Law: Indicate the jurisdiction that governs the payment plan.

Design Considerations for Professionalism and Trust

To create a professional and trustworthy credit card payment plan template, consider the following design elements:

Layout: Use a clean and organized layout with ample white space to improve readability.

Tailoring the Template to Specific Needs

While the above components are essential for most credit card payment plan templates, you may need to customize the template to address specific requirements or industry standards. For example, you may need to include additional provisions for hardship cases, or you may need to comply with specific regulations in your jurisdiction.

By carefully considering the key components and design elements discussed in this guide, you can create a professional and effective credit card payment plan template that benefits both your business and your customers.